Home > Family Office Services > Newsletters > Family Office Quarterly Letter

Family Office Quarterly Letter

Family Office Quarterly Letter

8 AVRIL 2022

Friday 29 April 2022, by

Q1-2022 was characterised by Russia's invasion of Ukraine and accelerating inflationary pressures. The severe human implications and the uncertainty of further escalation had consequences for equity markets, bond markets and many commodities (oil, gas and wheat in particular). The impact has been a further pick-up in inflation and serious complications in the production chain. In China, equities were affected by new measures in some very important cities.

Given this worrying situation, what direction should your assets take for the rest of 2022?

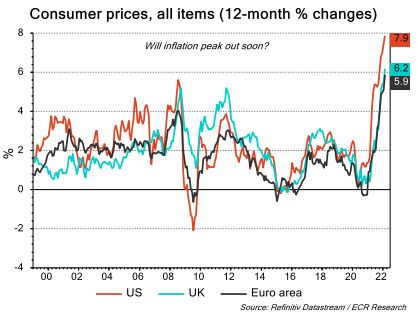

The US and EU sanctions aimed at crippling the Russian financial system will have enormous negative effects on global economic growth in the short to medium term. US inflation reached 7.9% in February. The Fed, at its FOMC meeting on 15-16 March, announced its intention to reduce the size of its balance sheet to counteract this high inflation rate and tight labour market conditions. In reality, these are only intentions but no decision to reduce the size of the balance sheet have been materialised. This will probably be the case at their May meeting.

Markets are not waiting. Short and long term rates have risen in anticipation of a restrictive policy (QT and rate hike) expected in the coming months. The 10 year yield, currently at 2.3%, will most likely be at 3.3% by the end of the year. US equities (excluding the Energy and Utilities sectors) have corrected downwards with the S&P 500 down 5.2%. In Europe, the FTSE Europe ex UK is down 7.7% (in €). UK equities held up better as the FTSE All-Share index includes commodity-related stocks. Japan fell by 6.2% (in $). The MSCI EMU was up 9.2%.

Overall, the MSCI World lost only 5.2% in $ and 3.1% in €. We expect a much stronger correction by the end of the year given the geopolitical instability, the continuing rise in inflation, the slowdown in the economy resulting from the rise in interest rates, and the inversion of the yield curve often heralding a recession.

In this context, expert opinions lead us to remain very cautious, especially as the geopolitical crisis only exacerbates the fact that the economic world remains extremely fragile. We are indeed far from being safe from a financial crisis that may happen quickly and with less possibility of containing it than in 2008.

It is therefore difficult to be positive again after this first correction of the year, which seems to us to be insignificant compared to the risk of deterioration in the global economic environment. This period is therefore a good time to start to focus on the potential attractiveness of some disruptive stocks or funds focused on promising themes such as food production, protection against cyber-attacks, and the most revolutionary technologies.

The core allocations, we typically consider, can be very different from what other firms may recommend. We are guided by capital preservation. In the current context, an allocation to equities should be minimised as much as possible except in certain sectors (energy and essential raw materials such as copper, nickel, gold and silver in particular). One can expect in all likelihood significant market correction. What we have seen so far is largely insufficient according to a several experts. But we should not lose interest in some very promising sub-sectors and innovative and financially strong companies (unleveraged balance sheet structures, leaders in the production of goods that are essential for growth and infrastructure development). Despite rising interest rates, we believe that M&A activity will continue and we continue to favour a large allocation to non-listed securities that can be accessed through well managed funds by private equity specialists.

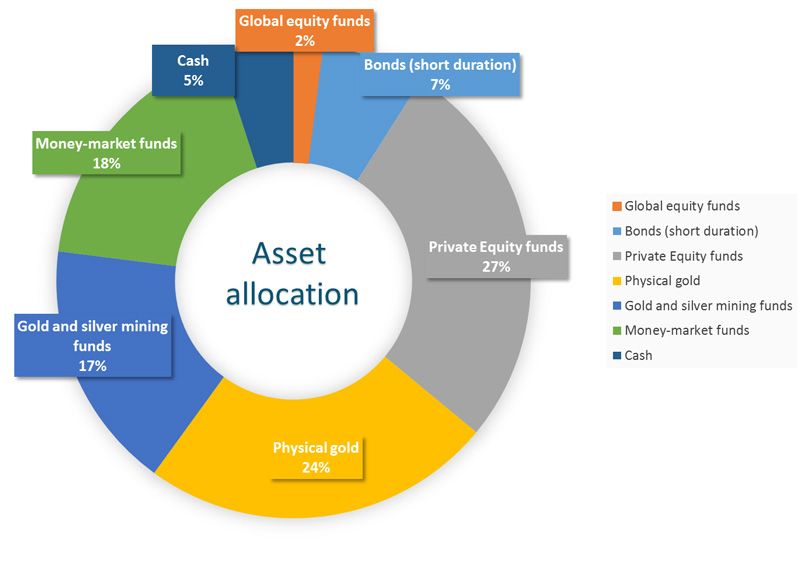

Just for illustration purpose, please find below the current asset allocation of one of our clients, a dynamic and reactive profile :

Bonds and money market funds will be partially used to meet outstanding commitments to private equity funds.

This allocation seems quite effective, so far this year 2022. The overall performance reached +3.85% in €, while the MSCI World fell by 3.1%. This represents an outperformance of almost 7%.

The advantage of such a structure is that it should allow the client to weather this period of instability without having to worry too much about market trends. Should the equity markets start to witness a more significant downward correction, it could be appropriate to make a change in the current asset allocation.

Wishing you an agreeable Spring Season.

Daniel Van Hove

Orionis Management

Orionis Management